Calvin Needs to Manage Cash Flow

Calvin knows that the lifeline of any business is its available cash. As long as there's enough cash to cover the business's upcoming expenses, it's still alive. That's why Calvin watches his company's cash balance like an ER Nurse.

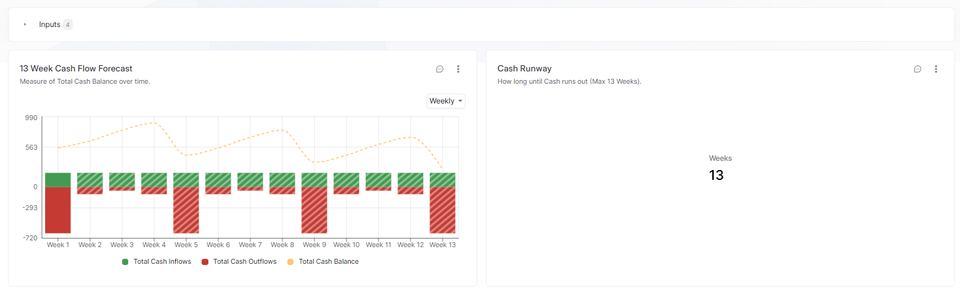

Cash flow management is critical to businesses of any size. The larger the business, the more categories of expenses, revenue, and cash accounts it has. But, the math is always the same. Measure current cash balance + inflows of cash - outflows of cash = ending cash balance. Calvin creates a cash flow forecast as soon as possible. This way he has a clear reference to answer "can I afford this?" Timing plays as much of a part in managing business decisions as expected outcomes do. That's why Calvin updates his cash flow forecast as often as possible.

Here are a few benefits of tracking your cash flow across the next 13 weeks:

- Know when to time major purchases and cash injections into the business.

- Avoid overdraft fees across bank accounts.

- Plan for both short & long term goals. This can include introducing new product lines or expanding into new markets.

- Manage your company's debt payments & cash funding.

- Cover your company's payroll & other ongoing business expenses.

Below is one outline that Calvin uses to manage his cash flow. Follow these steps to create your own 13 week cash flow forecast:

- Capture the current balances in your bank accounts.

- Capture any planned funding or major purchases over the next 13 weeks.

- Forecast your Revenue and Other Income over the next 13 weeks.

- Forecast your business expenses over the next 13 weeks.

Create your cash flow forecast then copy the results and save them wherever you'll be able to refer to them best.